Every insurance company will assess the value of your home before issuing the home policy.

The replacement value is the main factor in determining the policy premium; it is the cost of rebuilding your home to the same size and shape if it got completely destroyed. The size of the building, amount of bathrooms, kitchens and any custom finish will determine the replacement cost, which is calculated between $200 and $250 per square foot for the average quality home. Custom homes with more luxurious interiors are appraised with more details.

However, the replacement cost is not the only aspect that decides about the price. Here are the home factors that will inflate your insurance premium:

- Type of construction (frame vs. fire resistant)

- Close proximity to the tidal water or significant body of water

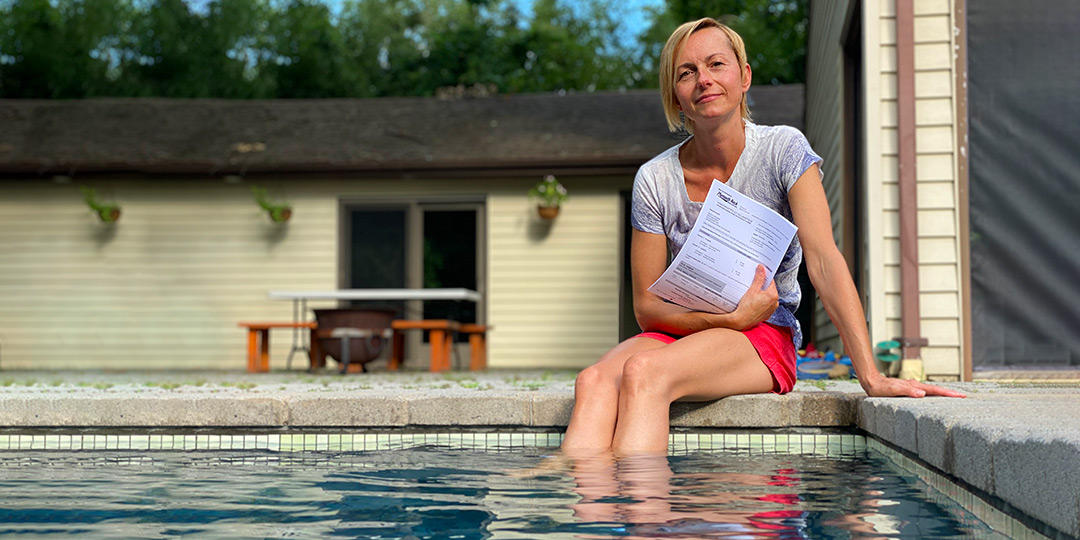

- Swimming pool or trampoline on-premises

- Dog breed (10-14 restricted breeds are on the blacklist)

- Long-distance to the fire station

- Old electric system (electrical fuses instead of circuit breakers)

- Flat roof or poor roof condition

- Wood-burning stoves

- Home-based business

A significant aspect of the home policy price will depend on the claims history. Each insurance company follows its underwriting guidelines and may deny your policy if you have a dog-biting claim history or some of the above conditions. The home liability limit and the deductible amount will also have an impact on your policy price. Your personal insurance score and credit history may also be taken into consideration.

If you have any questions regarding your home insurance, please don’t hesitate to call me at (973) 580-3992. I’ll be happy to assist you.

Are you OVERPAYING your insurance?

Let’s check; it doesn’t cost anything!

Related posts

Little insurance lies with big consequences

When disaster strikes but insurance denies paying the claim, financial hell breaks loose. It’s often caused by misleading information on the original application for coverage.

Temporarily Suspending Your Car Insurance

Going away for an extended vacation? Living for military deployment? Garaging your convertible for winter? All of the above trigger a question: do you need the insurance for the vehicle you don’t use?

Fraud affects your insurance cost. Prevent it!

Con artists are ripping off insurance (and indirectly you) by pretending to fall and get hurt. The price of these false claims is passed on to your insurance policy.

Get started online

Give us 24 hours and we'll give you the price!

PHONE

ADDRESS

258 DAYTON AVENUE

CLIFTON, NJ 07011

Serving New Jersey